Starting a business in Montenegro has many advantages despite the country not being a member of the Union European at the moment. Montenegro companies have the possibility of completing various activities within the EU, such entering partnerships with companies in countries on the entire territory of the EU and even engage in trading and other commercial undertakings.

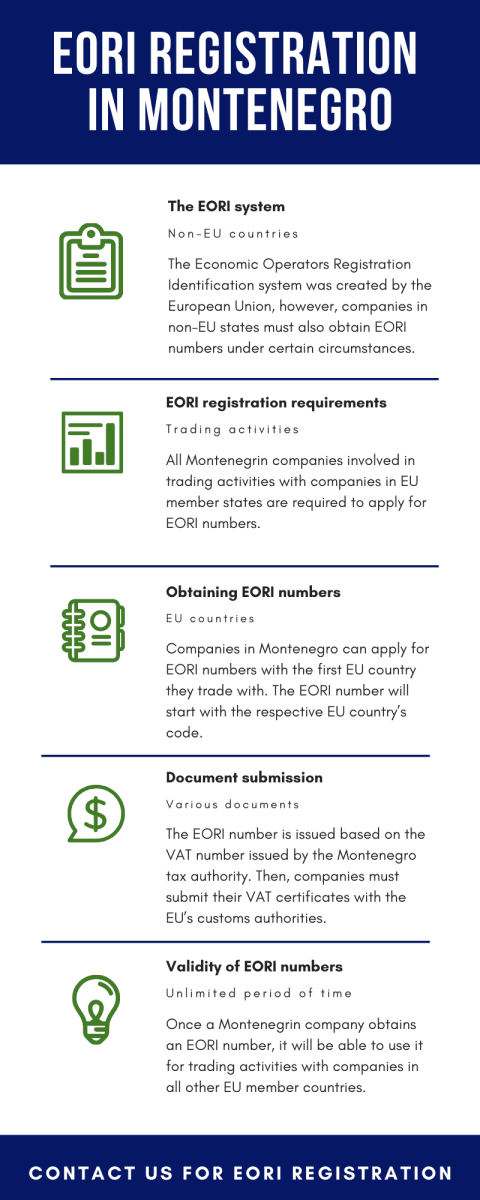

With respect to the trading activities Montenegro companies complete on EU territory it is important to note that in order to complete customs operations, these companies need register for the Economic Operators Registration and Identification system, or simply put to obtain EORI numbers.

Below, our company formation agents in Montenegro explain the EORI registration procedure. We can help you set up a business and register it for an EORI number in Montenegro.

|

Quick Facts

|

|

|---|---|

|

What is an EORI number?

|

Economic Operators Registration and Identification number

|

|

Who needs EORI registration in Montenegro?

|

Montenegro companies with trading activities in the EU

|

|

The Advantage of an EORI number in Montenegro

|

Easy customs procedures

within EU |

|

Documents required for EORI registration

in Montenegro |

– VAT certificate;

– Information about the sole trader/company; – Identification paper of the applicant. |

|

Why is it necessary to have an

EORI number in Montenegro? |

EORI numbers in Montenegro help traders to interact and perform trading activities in the EU states.

|

|

EORI registration processing time

|

On average it takes 3 to 10 days

|

|

EORI number format

|

Country code + unique code or number

|

|

EORI de-registration

|

Upon request

|

|

Online EORI registration available. (Yes/No)

|

Yes

|

|

Purpose of acquiring an EORI number

in Montenegro |

– helps in dealings with customs authorities;

– it uniquely identifies economic operators; – it must be quoted in all communications between the economic operator and the customs authorities; – for the purpose of exchanging information with other customs and government agencies. |

|

Validity of EORI number

|

It is valid for indefinite period

|

|

Who issues an EORI number?

|

Customs in the EU

|

|

Can non-EU nationals get an EORI number? (Yes/No)

|

Yes

|

|

Activities to be performed under an

EORI number |

Engage in trading and other economic activities.

|

|

Are EORI registration services available for both local and international trading companies?

|

Yes, we can help both local and international trading companies register for an EORI number.

|

Table of Contents

How to obtain an EORI number in Montenegro in 2024

The application for an EORI number can be filed directly with the customs authority in the first EU country in which the Montenegro company engages in import or export of goods or services or can be completed online, via email.

The documents that need to be filed when applying for EORI registration imply the VAT certificate which is mandatory, as mentioned above, information about the company or sole trader and an identification paper of the person applying for the number. In the case of companies, this person will be the representative of the business.

Our local representatives can offer more information on the documents required to register for EORI.

Structure of an EORI number

The EU’s EORI process started on July 1st, 2009. An EORI number in Montenegro is an identification number that is exclusive to the European Union. It is given to economic operators or individuals by a customs authority in a member state. An Economic Operator (EO) can receive an EORI number that is valid across the community by registering for customs in one member state.

The code obtained in the state of original registration comes first, then an exclusive economic operator identity number. All EU Member States’ EORI databases are included in the EU-wide EORI database. The EU – EORI Online Database allows users to check all EORI numbers online. However, it is important to note that occasionally the website may not include newly registered EORI numbers.

So, it is recommended to get the services of experts in this situation. Our company formation agents in Montenegro can provide you with due diligent information in this regard. In addition to this, if you are looking out to incorporate your company online, our agents can assist you with their services. They provide efficient online incorporation services in Montenegro.

The registration process for an EORI number

In different parts of the EU, the length and complexity of the EORI registration process vary. As Montenegro is still not part of the European Union, so you are welcome to consult with our company incorporation consultants about the EORI number registration process in detail. It is significant to note that depending on whether a corporate company is founded within the EU or not, the procedure changes, however with the help of our experts, you do not need to hassle much.

An EORI number can be obtained in the country of origin for a business or a sole proprietor established in one of the EU member states. However, the first customs entry point into the EU for those business entities founded outside of the EU will be where they register for their EORI number. After registration, the EORI number is recognized throughout the entire European Union.

If you need comprehensive details about the registration of an EORI number and how to avoid complexities during the process, you can consult with our agents. They can offer you practical help with EORI registration in Montenegro. In addition to this, if you are planning to open a branch office in Montenegro, the services of our company incorporation consultants are at your disposal.

The EORI registration system and its importance

The Economic Operator Registration Identifier system was introduced by the Security Amendment to the Modernized Customs Code in 2009. It came as a security measure for all companies in the EU involved in customs activities. EORI came as a replacement for the Trader’s Unique Reference Number (TURN).

EORI numbers fall under the EU Regulation (EEC) No 2913/92 which applies to economic operators registered in EU member states. In other words, only EU-based entities are required to apply for EORI registration. Companies registered outside the EU, such as the case of businesses in Montenegro, are not required to apply for EORI number up to the point they engage in customs operations on any of the EU member states’ territories. Considering many companies in Montenegro have trading relations in EU states, it is safe to say that obtaining EORI numbers in 2024 is of great importance.

Those who want to open companies and need assistance in registering them for the EORI system can rely on our company registration advisors in Montenegro for both procedures.

What are the entities requiring EORI registration in Montenegro?

Not only companies need to apply for EORI registration, but also sole traders and even natural persons who need to go through customs operations on EU territory. An important aspect to consider when applying for an EORI number as a Montenegro entity is that a VAT number is required, therefore the authorities in the country in which the EORI number is requested will issue this unique reference based on the Montenegro business or person’s VAT number.

Our Montenegro company formation specialists can help local companies and sole proprietors apply for VAT numbers and obtain VAT certificates required when applying for an EORI number. These certificates are issued by the Montenegro tax authorities.

You can read about obtaining an EORI number in Montenegro in the scheme below:

Value added tax (VAT) regulations in Montenegro and the link to the EORI system

The value-added tax in Montenegro is based on the same-named law, which experienced several revisions in 2017. The government implemented a few modifications at the time, including:

- – Business-to-business services are now subject to new laws relating to the determination of the place of their supply;

- – Business-to-consumer services may also be subject to new restrictions regarding the place of supply;

- – The new standard rate was established at 21% from the previous 19% rate;

- – The limit for imported goods to be free from VAT was lowered to 75 EUR.

Although Montenegro is not a member of the EU, its VAT legislation complies with EU rules on this tax to facilitate access for businesses operating in the EU to the local market and vice versa. Our agents can guide you about the importance of VAT numbers for acquiring Montenegro EORI registration. Besides this, if you are planning to relocate and apply for Montenegrin residency, you can get in touch with our specialists.

Activities completed under an EORI number

Companies in Montenegro seeking to apply for EORI registration will obtain access to various services with the EU customs authorities. Among these:

- the right to file customs declarations with the authorities of all EU member states;

- the right to submit Entry Summary Declarations with the customs authorities in the EU;

- the right to file temporary storage declarations on the territory of other EU states;

- the right to act as carriers for transporting goods by sea, air or land in the EU;

- the right to obtain various notifications and information from all EU states customs offices.

Applying for EORI registration in Montenegro in 2024 is not a complicated procedure and our agents can explain it step-by-step. We can also help with this process upon your first interaction with the EU Customs.

Why should Montenegrin companies apply for EORI numbers in 2024?

Montenegro is preparing to enter the European Union which is a great opportunity for trading companies here to expand their operations to countries that are already part of the EU. Obtaining EORI numbers as companies registered in Montenegro in 2024 is not conditioned by the country being an EU member already, therefore in order to ease future procedures, local businesses can register for the EORI system sooner.

Obtaining an EORI number as a Montenegro company in 2024 does not come with any obligations, only with benefits, among which easy customs procedures within EU boundaries. Moreover, the number needs to be obtained once in order to operate throughout the entire European Union.

If you want to register for the EORI system from Montenegro in 2024, our local agents are at your service with information and guidance.

How long does it take to register for an EORI number?

Everything is dependent on the nation in which the registration is made. However, the entire process often takes between three to ten days. In some nations, the procedure is straightforward and takes less time to finish than in others. The applicant’s initial nation of registration or place of business, along with other considerations, may also have an impact on how long the procedure takes. An EORI number is typically processed in 3 to 10 days. Our company incorporation consultants are always available to help you navigate the wide range of variables in your particular circumstance. Their assistance would give you an idea of how long your EORI registration in Montenegro is going to take. Furthermore, our company incorporation experts can offer you thorough guidance on shelf company structure and regulations in Montenegro.

Trading in Montenegro

Montenegro has important trade ties with the European Union, Germany, Poland, Hungary, Italy, and Greece being among its most important partners. Also:

- Montenegro’s overall exports of commodities from January to May of 2023 totaled 1.755 million EUR, a 12.2% increase over the same period the previous year;

- a total of 1. 440 million EUR was imported, and 315.7 million EUR was exported in commodities;

- at the same time frame the previous year, imports rose by 17.2% while exports fell by 6.1%.

- Compared to the same period last year, when the coverage was 27.4%, the import-by-export coverage was 21.9%, which was less.

Mineral fuels, lubricants, and related materials accounted for the majority of exported products with a total value of 171.1 million EUR (including 162.8 million EUR from electric current and other sources).

The most imported products were machinery and transport equipment, accounting for 339.6 million EUR (comprising road vehicles, which accounted for 123.5 million EUR).

For assistance in EORI registration, please contact our consultants in Montenegro. Moreover, your EORI number can be de-registered upon request. In 2024, to deregister an EORI number in Montenegro, you would need to follow the process outlined by the Montenegrin Customs Administration. You will submit a written request for deregistration to the Montenegrin Customs Administration. The request should include the reason for deregistration and any supporting documentation. Then the Customs Administration will review the request and may request additional information if necessary.

Furthermore, if you want to get citizenship by investing in Montenegro, our agents can assist you. They can guide you about reliable areas where you can invest your capital to get citizenship in this country.